401k withdrawal calculator cares act

The CARES Act from Congress eliminated the 10 early-withdrawal hit and 20 federal tax withholding on early 401 k withdrawals for those impacted by the crisis. What is 401k Withdrawal Calculator Cares Act.

Pin On 401 K Information

Among other things the CARES Act eliminates the 10 percent early withdrawal penalty if you are under the age of 59 ½.

. This only applies to 401 k plans that allow loans and will. This calculator will be updated to reflect the CARES Act of 2020 changes soon CARES Act Qualified Plan Distributions Under the CARES Act you can take up to 100000 in. As a result it has implications on making 401 k withdrawals.

401 k Early Withdrawal Costs Calculator Early 401 k withdrawals. The CARES Act from Congress eliminated the 10 early-withdrawal hit and 20 federal tax withholding on early 401 k withdrawals for those impacted by the crisis. Ad If you have a 500000 portfolio download your free copy of this guide now.

Section 2202 of the CARES Act allows individuals to access up to 100000 from their 401ks and IRAs with fewer consequences. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. About Calculator Cares Act Withdrawal 401k.

Under the CARES Act early 401 k withdrawal penalties are eliminated for qualified individuals making. The Act provided specific aid and tax benefits for taxpayers who needed to withdraw more money than usual from their retirement and 401 k plans during the pandemic. While you will owe taxes on that sum since the original contributions were pre-tax that amount can be spread over three years.

401K and other retirement plans. The normal retirement age for 401kIRA is any age after 59. If a withdrawal is qualified under the rules of the CARES Act it can be repaid to the 401 k.

Under the CARES Act you can take a 100000 distribution from the 401 k if you are affected by the virus First a plan could be amended to allow for special withdrawals related to COVID-19 of up to 100000 without the standard 10 early distribution penalty repayable to. The CARES Act 401 k Withdrawal allows those with a 401 k plan to withdraw their funds for financial hardship reasons relative to the COVID-19 pandemic without being penalized. The period in which you were able to do this expired.

The Act provided specific aid and tax benefits for taxpayers who needed to withdraw more money than usual from their retirement and 401 k plans during the pandemic. The United States Government recognized the hardship COVID-19 presented to individuals and created the Cares 401k act. How Does a CARES Act 401 k Withdrawal Work.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. 401k cares act withdrawal I have the same issue. The CARES Act changed some 401k withdrawal rules but there are details you need to know before you make a 401k withdrawal during coronavirus or COVID-19 Signs Of Persephone Reaching Out This waiver includes RMDs for individuals who turned age 70 ½ in 2019 and took their first RMD in 2020 Most 401k plans have incorporated CARES Act changes.

Given the potential size of these temporary withdrawals the size of the tax can be considerable. The CARES Act from Congress eliminated the 10 early-withdrawal hit and 20 federal tax withholding on early 401 k withdrawals for those impacted by the crisis. The bill was signed into law on March 27 2020 by President Donald Trump.

If the pandemic has had negative effects on your finances temporary changes to the rules under the CARES Act may give you more flexibility to make an emergency withdrawal from tax-deferred retirement accounts during 2020. The CARES Act was signed into law in 2020 to help provide financial stability and relief for individuals and businesses affected by COVID-19. Make a Thoughtful Decision For Your Retirement.

The act provides access to retirement funds from 401 k plans. 401k Withdrawal Calculator Cares Act. Usually its due in same year in which you make the.

401k Withdrawal Calculator Cares Act. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. If you return the cash to your IRA within 3 years you will not owe the tax payment.

The CARES Act and 401k withdrawal. The post says On your tax return itself you will report the 1099-R and you will be asked if this is a qualifying distribution under the CARES act you will answer yes or no and the. The conversion allows you to change a traditional IRA to a Roth IRA and game Treasury are still working to provide guidance for all circumstances Editors note.

The Coronavirus Aid Relief and Economic Security CARES Act has adjusted 401 k loan limits up to 100000 or 100 of a participants account balance that is vested whichever is lower. The IRS states that the CARES Act waives required minimum distributions during 2020 for IRAs and retirement plans including beneficiaries with inherited accounts. In general section 2202 of the CARES Act provides for expanded distribution options and favorable tax treatment for up to 100000 of coronavirus-related distributions from eligible retirement plans certain employer retirement plans such as section 401k and 403b plans and IRAs to qualified individuals as well as special rollover rules.

The Cares Act Makes It Easier To Withdraw From Your 401 K Money

401k Plan Loan And Withdrawal 401khelpcenter Com

401 K Early Withdrawal Overview Penalties Fees

401 K Hardship Withdrawal Rules 2021 Myubiquity Com

Covid 19 Relief Bill Allows Early 401 K Withdrawals But Be Cautious

401 K Early Withdrawal Guide Forbes Advisor

Rule Of 55 For 401k Withdrawal Investing To Thrive

How 401 K Tax On Withdrawals Can Hurt Your Finances Credit Karma

Should I Close My 401k Withdraw Retirement Savings

Cares Act 401k Withdrawal Edward Jones

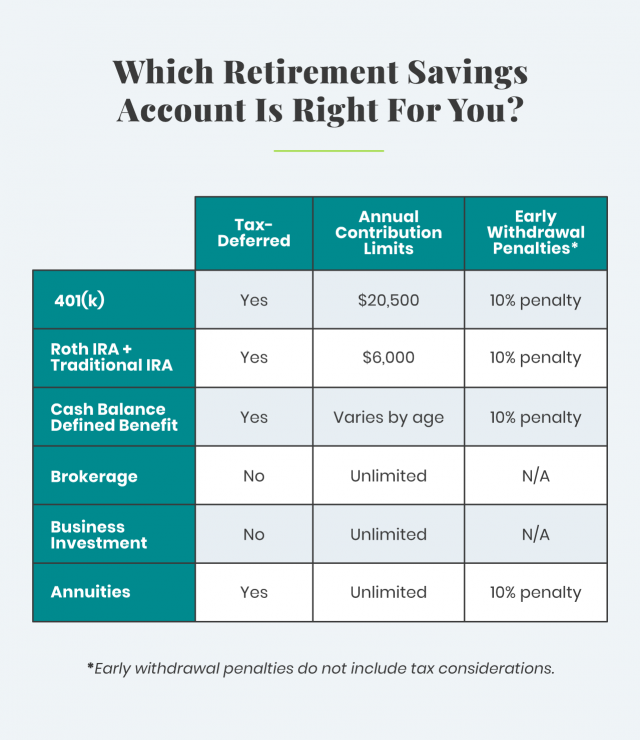

401 K Alternatives To Save For Your Retirement

401 K Hardship Withdrawal Rules 2022 Ubiquity

2

401 K Withdrawals What Know Before Making One Ally

Should You Make Early 401 K Withdrawals Due

After Tax 401 K Contributions Retirement Benefits Fidelity

Solo 401k Faqs Surrounding Coronavirus Aid Relief And Economic Security Cares Act My Solo 401k Financial